There might be light at the end of the tunnel, but it ain’t here yet.

Equities elite: The top manager running 10 funds

Latest Newsletter

Value stance rewards managers with first AAA rating

The year comes to a close with a host of managers gaining their AAA wings.

Real Life: A cheaper, smarter way to fly business to the US

Companies are clamping down on travel costs. Here’s how to travel in comfort while keeping the expenses department happy.

Community

It’s that time again when we take a deep dive into the 421 fund managers making our elite list.

In our first issue, we revealed the three groups that contribute the most elite managers to our list. Last time, we unearthed the asset classes where they collectively have most money at stake.

In this issue, Amplify reveals the 10 managers on the list who run the most funds.

And we talk tactics with Werner Roger, the man who runs the most of all – no fewer than 10.

In our interview with Roger we learn:

- How experience in tumultuous Brazilian markets has prepared him for current global inflationary forces.

- How he’s capitalising on four themes: capital goods, agribusiness, a commodities niche and logistics.

- The stocks he backs with high conviction and his methodology.

- How the funds are insulated from Brazilian interest rates and inflation, but swallowing a long exposure to China’s economic growth.

Top 10 equities elite by number of funds managed

The 421 equities elite managers run 553 funds between them. Below are the top 10 managers with the most elite funds managed.

Some quick data notes:

- The elite list is not ranked: the managers are already selected according to the methodology and they all have consistent risk-adjusted outperformance over the past 12 months.

- And these are not all the funds the elite manage – some may have funds that are not part of the data and our methodology only selects the funds in which the managers have consistent risk-adjusted outperformance over the past year.

Got that? Here we go:

| Manager | Gender | Group | Number of Funds | Total Fund Size ($m) |

|---|---|---|---|---|

| Werner Roger | Male | Trigono Capital | 10 | 437.3 |

| Mark Davids | Male | J.P. Morgan AM | 7 | 5166.1 |

| Howard Wang | Male | J.P. Morgan AM | 6 | 15333.5 |

| Rebecca Jiang | Female | J.P. Morgan AM | 6 | 15333.5 |

| Lars Erik Moen | Male | Danske Fund Management | 6 | 2356.8 |

| Franz Weis | Male | Comgest | 6 | 11813.2 |

| Mark Baribeau | Male | PGIM Investments | 5 | 14261.3 |

| David J Eiswert | Male | T Rowe Price | 5 | 9041.3 |

| Mark East | Male | Bennelong Funds Management | 5 | 5928.6 |

| Gerhard Wagner | Male | Swisscanto | 5 | 2428.1 |

Werner Roger, co-founder of Trigono Capital

Werner Roger is a portfolio manager and co-founder of Trigono Capital, based in Sao Paulo. He manages three long-only equity funds: Trigono Flagship Small Caps, Trigono Delphos Income and Trigono Verbier, all with 100% exposure to Brazil. He also manages:

- Trígono Delphos Income FIC FIA

- Trígono Delphos Income Instituc FIC FIA

- Trígono Flagship 60 SmallCaps FIC FIA

- Trígono Flagship 90 Small Caps FIC FIA

- Trígono Flagship Institucional FIC FIATrígono

- Trígono Horizon Microcap FIC FIA

- Trígono Power & Yield 30 FIC FIA

Roger has accumulated more than 36 years of experience in financial markets, having previously worked at Victoire Brazil Investimentos as a founder partner. He has also worked at other institutions such as Western Asset Management, Citigroup and Chase Manhattan.

Amplify’s Will Robins and Jonas Huruy Kidane talked to Werner to find the secrets of his success.

Jonas Huruy Kidane: Over the past 12 months, you have been rated AAA, the highest ranking Citywire gives to fund managers based on their monthly performance. What is it about the environment that enabled you to consistently perform well?

Werner Roger: The world is in a very challenging environment. However, in Brazil, we have been facing challenges for years. In 2016, we saw the impeachment of President Dilma Rousseff followed by political reforms, an election, then Covid and now we face high inflation with another election looming later this year.

Since 2015, I have adopted a strategy of concentrating our portfolios in companies that invest their revenues in dollar-rated hard currencies. They are either exporters or have businesses abroad, or commodities in Brazil.

Our strategy had three purposes. First, even in 2015, 90% of our investors were foreign. Second, we have a very low turnover and are agnostic about benchmarks. We have 96% of our active management in the small-cap funds. Third, we have a bottom-up approach where we start our analysis with the companies and build a picture upwards to macroeconomics.

Another important fact is the way we do our evaluation differently than the market. Trigono Capital is, as far as I am aware, the only asset manager in Brazil that uses economic value added (EVA) as a tool for evaluating companies.

We look at the market valuation and we compare our methodology with the market. We look at the gap between our valuation and the market, where our evaluation is much higher than the market, and where there is good liquidity – that’s where we concentrate our portfolios.

Today we have about $500m in assets under management and 70% of our investment is concentrated in five names, including manufacturer Tupy, agribusiness Kepler and Ferbasa in the commodities sector.

Jonas: Apart from the environment and the firm’s approach to investment, what’s your personal philosophy and approach?

Werner: My background is credit. We are long-term investors where the market is illiquid. I was involved in asset management in Brazilian local bonds, which was a very liquid market. As a long term-investor, first, I am not looking for the next quarter or next year. I am looking to at least two to three years and beyond.

Second, we don’t follow the consensus and I am not afraid to be wrong. We have strong conviction in our analysis, we take risks that are working. We started with eight IT companies with our flagship small-cap fund that has enabled us to make good returns.

Jonas: What can you tell us about the companies you invest in?

Werner: We are concentrated in four industries. First is capital goods, an industry the sell-side does not like, especially when Brazil was in recession. However, this is a good opportunity for us because it is a niche, and the companies are producers of components for heavy industries such as transportation and trucking.

One of these companies is Tupy which is the largest iron block and heads manufacturer, holding more than 50% market share. Major clients are Caterpillar, John Deere, Case, New Holland, Ford, Daimler, Stellantis and Cummins. In 2021, Tupy acquired its major competitor, Teksid, owned by Stellantis, and in May it announced the acquisition of engine manufacturer MWM from Navistar, entering the engine market. More than 60% of total revenues are generated in foreign markets (the US is the major market).

The second sector is agribusiness where we hold two names. The first is Kepler Weber, a 95-year-old steel silos manufacturer with about 40% market share in Brazil. Brazil is producing about 200 million tonnes of grains and has the capacity to store up to that amount.

Since Brazil also serves as China’s silo, the demand for production and thus storage of grains is expected to go up. The second is São Martinho which is one of the world’s major sustainable sugar and ethanol producers, and one of the most profitable. Over the past five years, even with price volatility, the company was able to return an Ebitda margin of over 50%. The company also sells 1.1 mega tonnes of carbon credits, so it’s very ESG compliant.

The third sector where our portfolio is concentrated is a commodities niche and we have major holdings in a company called Ferbasa the largest producer of ferrochrome and ferrosilicon alloys employed in stainless steel and carbon steel manufacturing.

Over the past 25 years, Ferbasa’s shares posted a 31.6% compound annual growth rate (CAGR) in local currency and 23.7% in dollars, the highest return in Brazil´s stock market for such a period.

The fourth sector is logistics, and we hold a company called Simpar which is Brazil’s largest logistics group, and also a top-three rent-a-car operator. Over the past 12 years, Simpar posted an impressive CAGR of 20% for revenues, 27% Ebitda and 29% net income, even under adverse economic conditions, high-interest rates and recession in 2015.

Another thing is that we have little exposure to interest rates [12.75% in Brazil at the time of writing]. Our companies are cash-rich and can fund themselves for the long term, so we don’t have interest rate risks. However, we are long in China in the commodities sector, so there may be a risk being tied to China’s growth, but our companies have wide margins and a very strong balance sheet that enables us to handle these risks.

Will Robins: Inflation is rising in Brazil [12.13% at the time of writing]. How exposed or affected are your holdings?

Werner: Despite the semiconductor crisis, last year was the second-best year for truck production in Brazil’s history. The best year was 2013 in this industry. This year will be even better where the major names like Scania, Volvo and Caterpillar are performing quite well. The wait for trucks can take up to six months at the moment, not because of supply chain problems but because of demand. This shows that our economy, the real economy, is really strong.

Jonas: Back to the elite, there are managers with higher AUM but fewer funds, and others like you with smaller AUMs but across many funds – 10 in your case. Which choice is better in your eyes?

Werner: We have different funds but there is an overlap. We believe in the long term, so dividend is very important for us. Our Delphos fund had a 20% yield last year just on dividends. The other funds in small-cap had a 9% yield.

We also have different strategies – small-cap is a kind of alternative strategy, our Delphos fund is a major dividend payer, Verbier is all-cap, small, large and dividend, and Horizon is a micro-cap. We offer our investors a variety of options, kind of like a supermarket, you choose what you want.

Will: We’re interested in how things work and how you operate as a manager. You are the named manager on these multiple strategies, how are you able to give the right amount of time to all of them?

Werner: We have a team, we have a trader and three analysts and we are hiring more. I should also mention that 30% of the team are women. We have a committee every Monday morning where we look at the international and local environment.

The analysts, including myself, are generalists so everyone looks for everything which gives us a holistic picture. Although I make the final decisions, I stimulate the analysts to bring in new names.

However, I am also involved throughout the process, including conference calls with companies etc. We do our valuations and compare. If everything adds up, then we decide to invest. Trigono is four-and-a-half years old, but we have 110,000 investors. We are also supported by digital technology, which aids distribution.

Will: Are there any future trends you hope will generate returns for your investors?

Werner: As I mentioned earlier, my background is in credit, and this makes me different because I am concerned about the balance sheets of companies, and cash flow. I don’t like leveraged companies or stories. I like good management and factual investments, not bets on the future.

I am conservative – it may look like we take too much risk, but this is not the case. If you look at our volatility, it’s not high and is below the benchmarks. We don’t do derivatives and we are a bit old fashioned in that sense.

Book recommendations:

Mindset by Carol S. Dweck: ‘a book about human behaviour’.

Poor Charlie’s Almanack: The Wit and Wisdom of Charles T. Munger by Charles Munger: ‘I own a signed copy from when I met Munger in 2007.’

You may not know…

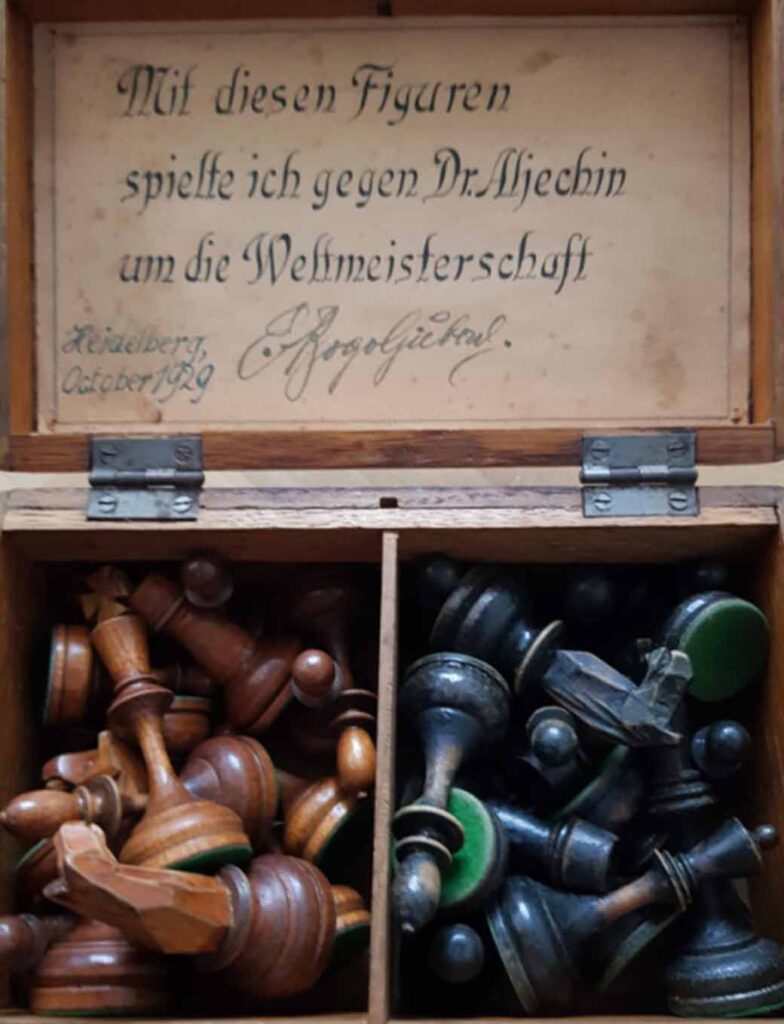

Roger owns a board and pieces from the 1929 World Chess Championship in Heidelberg. Roger’s grandfather, Osvald Mueller-Roger, ‘a great chess player’ was invited to referee the match between Efim Bogoljubov and titleholder Alexander Alekhine. ‘My grandfather taught me how to play chess when I was 11 years old and gave me the chess box and the pieces from the championship as a trophy for my victory when I won a match against him. It took my father 40 years to win against my grandfather.’

Latest Newsletter

Amplify Issue 30: The fund groups topping the tree

We analyse which groups have had the biggest inflows and outflows in 2022, look at managers achieving their first AAA ratings, and hear from Rob Kyprianou on why regulation gets it back to front.

Amplify Issue 29: Red hot: 2022’s private market hiring spree

2022 has been a hot year for private markets, but are asset managers putting the brakes on their expansion efforts? Plus, we look at how the bear market has affected launches this year and look at how firms can better communicate their brand values.

Amplify Issue 28: Fill your ESG product gaps

We hear from fund buyers on what they’re looking for from an ESG fund, find out what Neuberger Berman is plotting in the alts world, and learn the winners of Citywire’s Gender Diversity Awards.

Community